Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Why the project exists

Let's start with the basics, the Solana (SOL) token has a current market cap of $66B (09.2024). Meanwhile the TVL of SOL, accounting for every yield method known, is only $11.5B (09.2024). That means there is close to $55B worth of SOL tokens that are yet to be deposited in earning protocols. In other words, 82% of the SOL tokens are neither staked nor deposited in a yield-earning platform, thus not maximizing their revenue potential. And that is only talking about Solana. If we look at the Solana ecosystem as a whole, the total market cap approaches $85B, which represents a huge potential market. We, at Alchemis believe that this enormous gap is mainly due to the difficulty to access knowledge and to assess the quality of the many protocols available. In an ecosystem that possesses more than 163 such protocols, it is indeed challenging to determine which one has the best yield, the best security, the most optimal deposit period and overall the most suited for the user's need.

That is why we are creating a user-friendly protocol that automatically assesses the "quality" of different Solana-based earning protocols, as well as their respective tokens. It has a fully customizable investment strategy that enables users to start earning yield that is diversified into multiple protocols.

Welcome to the Alchemis finance documentation. This guide is designed to help you understand and use the Alchemis platform. This Documentation will be continuously updated as features evolve.

Alchemis is an advanced platform designed to simplify and optimize yield-earning and lending opportunities in the decentralized finance (DeFi). The goal is to enable users to diversify their assets into trustworthy yield-earning protocols. With the help of the its native token (ALS), Alchemis enables users to connect their wallets, set personalized risk preferences, and let our Ai analyst strategically allocate investments across the Solana blockchain. Alchemis not only analyses protocols, but also different tokens on these protocols to further optimize returns. In short, our protocol offers a tailored DeFi experience that balances risk and reward to meet individual financial goals.

Individualized investment strategy: Alchemis offers every user an investment strategy tailored to their needs by carefully choosing protocols that best fits their individual risk-tolerance and profit expectations.

Minimal risks: By diversifying users capital, Alchemis minimizes risks due to the weakness of one specific protocol or token.

Robust security: Alchemis emphasizes on security, thereby constantly looking for weaknesses, decentralizing crucial elements and developing a robust security network.

AI analysis: By using complex machine learning mechanisms as well as extensive data collection, Alchemis is able to provide users with the best yield-optimizing opportunities in DeFi.

The ALS token has the goal of simplifying DeFi by providing one single token that takes advantage of every earning opportunity on Solana. Users will be able to deposit ALS on the protocol, thereby diversifying their assets and earning strategies. The second use case of ALS is its potential as collateral for the native incentivized liquidity pool of Alchemis.

Alchemis has been founded by five blockchain developers with previous experience in DeFi and development on Rust. The team receives regular help from external advisors for other processes of the business as well as new insight for the development. With the vision to simplify Decentralized Finance on Solana, the team started developing a yield-optimizer protocol, emphasizing on simplicity of utilization and risk-minimization.

Official information will always be provided through our website or other official channels. Alchemis will never contact you directly. We still haven't issued ALS and do not have deployed the interface, any change will be communicated by official means.

Website: alchemis.finance

Twitter: x.com/Alchemisfinance

Analys is the technical term to define our DeFi protocols analyst. It's aim is to provide a complete analysis of all protocols on Solana, as well as the different tokens. By putting the two together it will propose a complete investment strategy.

We will use the technical term Token Aggregation Framework (TAF) to define every combination of protocol with its supported tokens. It means that a protocol that offers yield on 10 different tokens is composed of 10 TAFs.

This documentation, for simplicity reasons, will separate the explanation of multiple processes, even though they run simultaneously in reality. The purpose is simply to clarify understanding, the readers must bear in mind that the processes described in the followings run simultaneously.

First, we will explain separately the protocols analysis from the token analysis. In practice, these two processes occur simultaneously and are closely embedded within each other on the multiple steps.

We will also separate the expected yield calculation from the risk calculation, when in fact they are combined when being used to suggest the final investment strategy to the user.

As the reader can see in the following pages, Analys uses various external protocols to power the protocol. This is because the Alchemis team believes it is more time-efficient, secure and more cost-effective to use existing well-established functioning protocols if they fit the exact needs of the various stages of development. In the future, Alchemis plans to replace these external sources with alternatives of its own if slight changes have to be made.

Protocols AnalysisTokens analysisThe next subpages cover how Alchemis harnesses the power of machine learning to improve its performance.

Frequently asked questions

Technical terms definitions

Analys: The protocol that analyses all the different protocols on Solana

Token Aggregation Framework (TAF): The combination of each token for each protocol

Impact Factor Score (IFS): The results obtained from the machine learning to infer the most important criteria for the determination of real yield.

Principal Component Analysis (PCA): The reduction of the criteria used to infer a yield to only the most important criteria.

Risk Influence Score (RIS): The results obtained from the machine learning to infer the most important criteria for the determination of risk.

Compass: the interface and system that enables users to deposit their tokens and track their earnings

When users want to withdraw their funds, they will simply access the compass interface and click on "withdraw" to start the withdrawal process, which is as following:

By withdrawing their funds, users effectively burn their vALS tokens to initiate the withdrawal processes on all the platforms where their funds are located. The inverse process as for deposits is then initiated, and the funds withdrawed from the secure vault to directly be deposited on the user's wallet.

Important not: Since most of the earnings are made in other tokens, they are independent of the price of ALS, which means that ALS price fluctuations will NOT impact users' yield. The ALS tokens are simply bought back at market price when the withdrawal is requested.

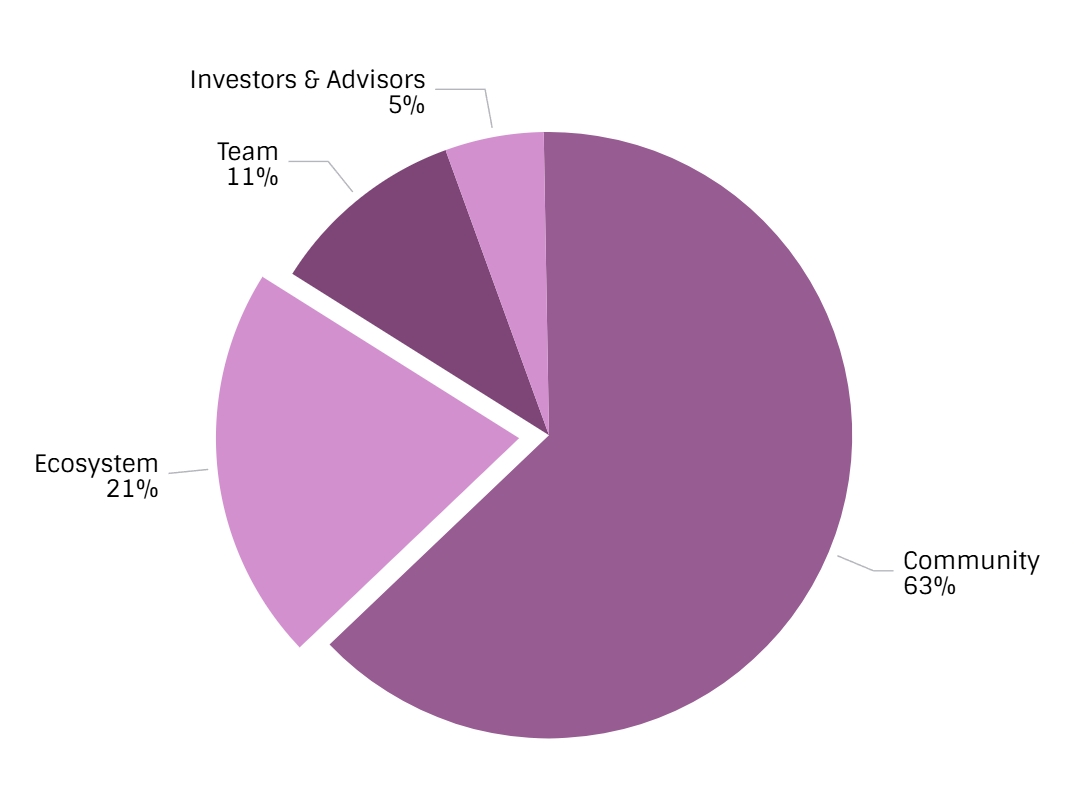

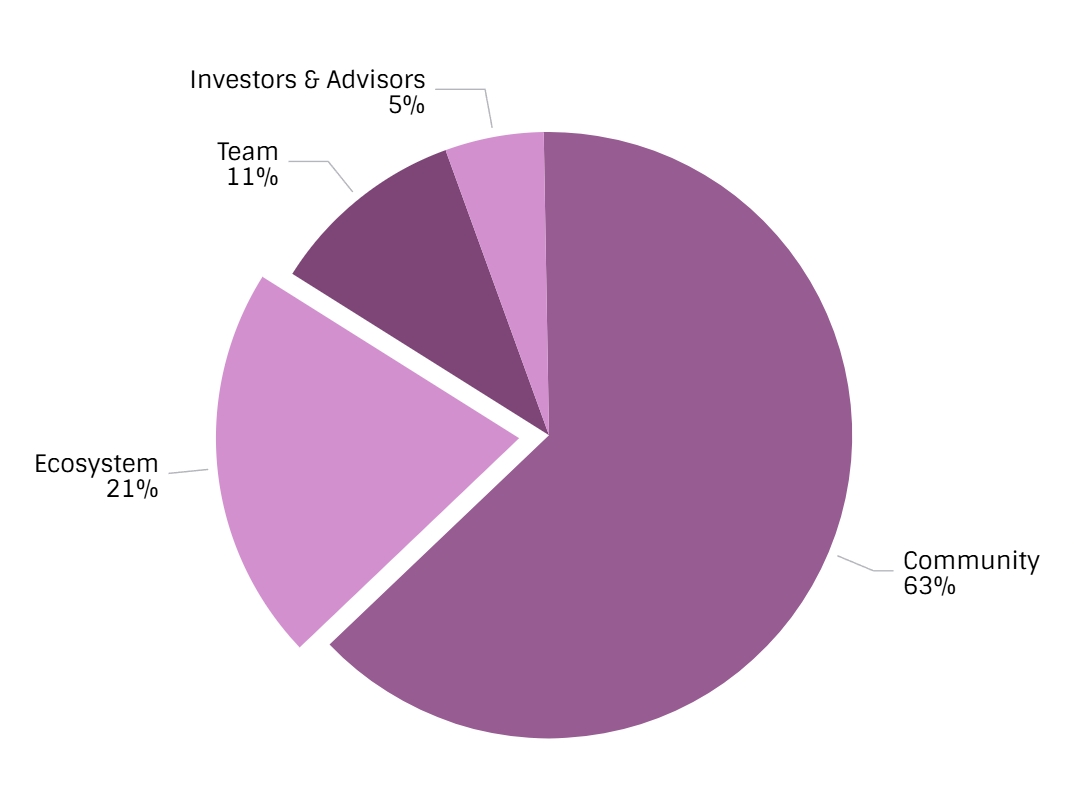

Ticker

$ALS

TGE

Q1 2025

Total supply

210'000'000

Network

Solana mainnet

Community

100% at TGE

Ecosystem

25% at TGE, 24 months logarithmic vest

Team

3 months cliff, 9 months linear vest

Investors & Advisors

3 months cliff, 12 months linear vest

How Analys evaluates different tokens.

Now, the objective is to essentially do the same as with the protocols analysis but with the different tokens. As previously mentioned, these steps occur simultaneously with the protocol analysis interact with each other on multiple levels.

Taking token characteristics into consideration for analyzing real yield is a very straightforward theory. Staking 2 different coins on the same protocol and with the same apy might seem equivalent but this is without consideration of the price evolution. If one token's price sees a 25% increase while the other's barely changes, staking the first token will obviously result in a much greater gain.

Analysis collects on-chain data of the different tokens in a similar way as for the protocols. Again using to query information with the use of Subgraphs. Here is a list of all relevant data collected: -Market cap -Aggregate volume -Aggregate liquidity -Circulating supply -Token issuance rates

In term, these are stored by combining's technology together with Alchemis' innovations to ensure secure and reliable storage.

Very similarly to the TAF analysis, Analys can then evaluate the evolution of the different metrics, separately and together to create additional secondary data for each token. Complementing these data with temporality enables Analys to determine metrics such as volatility, market cap average change percentage or volume in relation to market cap evolution. These metrics are essential to deepen the analysis of a token.

Note: To reduce costs whilst ensuring a maximal quality, Analys runs a data collection and storage for each token every 5 minutes.

By putting together all the data mentioned above, Analys is capable of assessing a multi-factorial dataset of each token, similar to the TAF analysis.

Compass

Compass is the name of the interface and system that enables users to deposit their tokens and track their earnings.

Compass allows users to deposit ALS tokens into secure smart-contract vaults that interact with multiple yield-earning protocols. These smart-contract controlled vaults operate under certain conditions for interacting with different DeFi protocols. Assets can only be moved according to the rules encoded in the smart contract. This means neither Alchemis nor users have a direct access to the assets, ensuring maximal security. It operates only according to the encoded parameters.

When users deposit ALS tokens into Compass, they are assigned to a personalized vault. This vault is governed by smart-contract rules that handle various interactions with different protocols according to the previously stated preferences of each user.

After making a deposit, users are receive non-tradable tokens (vALS). These tokens:

Represent the user’s ownership and share of the vault, they act as a sort or receipt.

Are non-tradable and non-transferable, meaning they cannot be sold or exchanged.

Can only be used to redeem the original deposit and accumulated yield from the vault, and are in term burnt.

Compass calculates each user’s earnings based on the performance of their individualized strategy. This means that Compass offers users a dashboard that displays how much they have earned since the original deposit. This enables users to track their investment.

The "getting started" process planning and documentation is still in development, we thank you for you patience, a complete documentation for this section will be available soon.

For every yield greater or equal to 8%/month (calculated in $USDT), 1% of the earning is burnt, ensuring a bullish price expectation. These could be considered "fees of the platform" but effectively contributes to increase ALS token price, setting larger performance expectations.

How analys deals with staking requirements.

Note: this section's aim is to clear up certain concerns about deposit requirements of various protocols, it doesn't introduce any new concept.

As mentioned previously, Analys collects data about minimal deposit requirements if existing. This data doesn't need much further explanation but it is important to note that these will be taken into account when the user decides to start investing with Alchemis by hiding protocols with minimal deposit amount higher than the planned investment.

As some protocols in the DeFi space require users to deposit their funds for a certain amount of time, the minimal period is also taken into account when assessing the risk (a longer period meaning higher risk). It will also notify the user that a specific protocol will "block" his funds for a certain period of time. This is the main reason why the interface asks users about their expected earning period, which directly influences which protocols will be used.

Alchemis puts a lot of emphasis on security as well as risk-diversification. Although we always improve every aspect of our own protocol's security, risks on the yield-earning protocols can never be completely controlled. Thanks to Analys, the risks are always taken into accounts when suggesting an investing strategy, but risks nevertheless are simply part of the crypto game. We advise every user to be cautious with their assets, cryptocurrencies involve risks.

To begin, risks on the protocols side need to be addressed. There are mainly 2 types of risks on this level. The first one being that the protocol is a non-trustworthy scheme aiming to deceive users. These protocols unfortunately exist in the space and it is important to recall their existence. However, these risks are almost zero with Alchemis. The reason is that Analys had to run a complete evaluation of the project before letting users invest their assets in the protocol. In that sense, almost every recommended protocol is worthy of trust on the user side.

The second type of risk is the probability of a hack or other malicious attacks on a protocol. These sometimes happen in the space, therefore, Alchemis always recommends users a blend of multiple protocols, reducing the risks related to the weakness of one protocol.

Next, token-related risks need to be addressed, these emerge from the natural unpredictability of the market, which could drive a certain asset's price down, which in turn reduces the performance of the investment strategy for this particular token. These risks are mitigated by high-diversification.

Similarly to the expected yield calculation. Analys AI uses machine learning to assess which factors are the most important for determining the risk of a TAF. Temporality, as well as the other data collected previously shall be used to infer the determinants for an optimal risk analysis.

Analys AI uses many mathematical models to infer the most optimal way to calculate TAF risk, combining native mathematical models as well as AI-determined ones.

The goal of the machine learning analysis is first to determine the downside probability and the financial loss to later put the two values together as determinants for the risk.

Here is a non-exhaustive list of the most important native mathematical models used to determine risk:

Downside probability model: Statistical models, such as logic regression are used to estimate the probability of downside for each TAF. The formula for the downside probability is given by the logistic function, which ensures that the probability remains within the range of 0 to 1. This function is expressed mathematically as:

where represents the probability of loss, the independent variables, the coefficients and the independent coefficients.

Relative loss expectation model: Expected financial loss percentage is modeled using non-linear regression to capture potential losses based on each criterion. For example, a polynomial regression model is used to determine the relationship between a criterion and potential loss:

where represent the loss coefficients, the independent variables and the exponents for non-linear risk factors.

Dynamic weighting system: In order to assess the relative weights, which evolve with time, each criterion’s weight is adjusted using a machine learning model that identifies patterns in past performance. Here is an example of the formula used for the determination of of P (note: This is the simplified version of the mathematical model used by Analys AI):

Where is the historical risk score associated with the criterion, allowing Analys AI to dynamically prioritize the most critical risk factors.

Note: These are the basic models used by Analys AI to run the machine learning system in order to infer mathematical formulas. However this is a non-exhaustive list of all the models used, most of them being directly created by Analys AI. The models mentioned should help the reader understand the basis of the machine learning but in no way represent the full method (which would be too heavy to describe in such a short documentation and isn't fully developed as of right now (10.24).

Risk Influence Score (RIS) refers to the results obtained from the machine learning to infer the most important criteria for the determination of risk. It is therefore an evolutive weighted average of downside probability and relative financial loss in that scenario. Here is the formula used

Where is the downside probability of the criterion, the relative financial loss of the criterion, and the respective weights, and the respective non-linear factors for and .

Combining the present data for each TAF with the newly-determined RIS function, Analys AI is able to assess the RIS for each TAF for all possible timelines.

How Analys predicts real yield.

This page covers the important Artificial intelligence part of the project. It is about putting together price of the tokens and the fundamentals of the TAFs to give a realistic approximation of future real yield.

Real yield is here defined as the yield, adjusted for change in price of the respective token. It is therefore a complete evaluation of a TAFs earning potential, including all factors. Therefore, it is mainly the intersection of apy and token price change. Other minor factors, such as protocol fees are taken into account.

Real yield is calculated on the United States Dollar (USD) value of the different investments. This is because in a highly volatile environment, it is important to have an anchor value that is as stable as possible. In that case, Alchemis chose the USD.

Since the different data collected often are of a subjective nature in relation to the final expected returns, a strict program of a grading system isn't optimal, since it would only take value as they are. That is why the development of an artificial intelligence is mandatory for a protocol such as Alchemis. Once the machine learning has been validated, the AI model will hardly change, only weightings will have the possibility to change over time, under specific circumstances.

However, the factors used will be fixed, these mainly include apy, protocol TVL, token market cap and liquidity. While other factors are used, about 80% of the findings rely on these four elements.

Analys AI is an advanced machine learning system designed to conduct complete analyses of each TAF. By leveraging a robust database built from historical data, Analys AI can evaluate the actual yields generated by different TAFs in the past. The goal at this point is only to determining which factors are the most important for the determination of real yield.

Previous dataset of token and TAF will be the basis for the criteria described in this section. Temporality is also an important criterion used for the determination of real yield. Results will have different values for each temporality.

Analys AI possesses native analysis techniques as well as the ability to create further mathematical models to assess the most important criteria. Here are some of the most important and understandable native mathematical functions embedded in Analys AI's code:

Linear Regression Models: These models are used to infer yield outcomes based on multiple independent variables (criteria). The general formula can be represented as:

where is the yield, the independent variables (criteria), the coefficients and the incertitude (the deviation of the results from the mathematical model).

Polynomial regression: Similar to the previous model, this model is used when the relationship between a criterion and yield is non-linear. This model uses polynomial terms to better infer the most important criteria. It can be represented as:

where is the yield, the independent variables (criteria), the coefficients, the exponents and the incertitude (the deviation of the results from the mathematical model).

Logarithmic Transformations: Both of the previous models can be modified with the use of logarithms to normalize distribution.

Multicollinearity Assessment: Analys AI assesses multicollinearity among independent variables to ensure that the criteria used do not excessively correlate, ensuring multiple highly-related criteria don't have an excessive weight.

Principal Component Analysis (PCA): If a large number of criteria are analyzed, PCA can be employed to reduce dimensionality while retaining essential information. This is to reduce the amount of criteria used to only use the most relevant ones for the determination of real yield.

Note: These are the basic models used by Analys AI to run the machine learning system in order to infer mathematical formulas. However this is a non-exhaustive list of all the models used, most of them being directly created by Analys AI. The models mentioned should help the reader understand the basis of the machine learning but do not represent the full method. The goal of this short introduction was simply to help the reader grasp the main idea of Alchemis' use of machine learning.

The Impact Factor Score (IFS) is the native weighted scoring system used by Analys AI to quantify the influence of each criterion on real yield. It is a parallel process to the linear regression models to determine the impact of each criterion.

Each criterion is assigned a weight based on its previously calculated significance in the determination of yield. The formula runs as following:

where is the number of criteria used, each individual criterion, the weight of the criterion and the value of the criterion and the exponent of the weight. ensures the float value represents the average and not the total.

Finally, by combining the present data for each TAF with the newly-determined IFS function, Analys AI is able to assess the IFS for each TAF for all possible timelines.

Disclaimer

Users of the Alchemis Ecosystem acknowledge and accept the risks associated with using the protocol, including the potential loss of funds. Your use of the Alchemis Ecosystem signifies your agreement to the terms and disclaimers outlined below. If you do not agree with these terms, please refrain from using the Alchemis Ecosystem.

How the smart-contract works

To start earning yield in different assets, Alchemis need to process swaps with different swaps or liquidity aggregators on the Solana blockchain. To ensure maximal security and efficiency, the same process as for the and is used to analyze the different protocols, the main factors being liquidity depth and price. Analys searches for a swap combination if the specific pair is not available. Once a swap path has been identified as trustworthy for the specific pair, Alchemis proceeds to the requests with the different smart-contracts on the behalf of the user.

Alchemis reserves the right to modify these Terms at any time without prior notice. Before accessing or using the Alchemis Ecosystem, please review the most recent version of these Terms. Any modifications will take effect as soon as they are posted here, and continued use of the Alchemis Ecosystem constitutes acceptance of the modified Terms.

The information provided within the Alchemis Ecosystem is not investment advice, financial advice, trading advice, or any other form of advice, and it is not guaranteed to be accurate, complete, or current. Our team disclaims all liability for any damages that may arise from the use of, reference to, or reliance on any information contained within the Alchemis Ecosystem.

he Alchemis Ecosystem cannot guarantee a loss-free experience. Investing in cryptocurrencies involves risks of financial loss and significant asset price volatility. It is the responsibility of users to understand these risks, conduct their own research, and determine their engagement strategies. Alchemis is not liable for any losses, damages, or claims incurred by users within the Alchemis Ecosystem. This includes, but is not limited to, user errors (such as sending payments to incorrect addresses); issues related to Alchemis software or associated service providers; actions or fraud by third parties; technical issues (malfunctioning DeFi wallets); and security challenges faced by the user (such as DeFi wallet mismanagement).

Alchemis and its contributors, unless otherwise mandated by law, shall not be liable for any damages, of any kind, caused by the use of the Alchemis Ecosystem

As with any young company, challenges may be faced during the product development phase, an extension of the development phase or changes in features must be expected by users as Alchemis still is in early development phase. Alchemis cannot promise that no severe complications leading to fundamental changes will arise.

While Alchemis conducts rigorous security tests, we do not guarantee a that vulnerabilities aren't present.

Users of the Alchemis Ecosystem must comply with all applicable laws and regulations.

Alchemis is not accessible to U.S. citizens or residents due to regulatory restrictions. Any attempt to access or participate in the Alchemis platform by U.S. persons is prohibited. We reserve the right to implement geographic restrictions and additional measures to ensure compliance with applicable laws.

The goal is to create a complete strategy that will be recommended to the end user.

By using the users preferences, Analys suggests them a complete investment strategy via the interface that can be deployed by the click of a button. The strategy corresponds to the reward to risk ratio, risk, deposit amount and earning period expectation information given by the user.

Through the Compass system, Alchemis proceeds to the different smart-contract interactions with the different protocols.

Important note: As previously mentioned, Alchemis never enters into ownership of user's funds, it does not have an access to the smart-contract, where user's assets are stored.

How Analys evaluates different protocols.

The goal at this point is to assess a multi-factorial grading of each token of each protocol and store these information in a transparent, cheap and decentralized way.

Analyis communicates with to collect the primary data it needs about all DeFi yield-earning protocols on Solana. Secondly, Analys communicates with to access real-time price feeds of the different TAFs.

Additionally, to access specific data about each protocol such as their yield, liquidity depth, deposit requirements or minimum staking period (if existing), Analys interacts with the different smart contracts in order to collect these information. It then send this data off-chain to store the final data as well as its evolution.

To minimize costs and offer a seamless user experience, Analys stores the data previously collected off-chain, in secure servers. This enables Alchemis to drastically reduce its costs, only storing critical information on-chain.

By storing the data, Analys can evaluate the evolution of the different metrics, separately and together to assess a general grade for each TAF. Complementing these data with temporality enables Analys to determine metrics such as mean yield as well as standard deviations to analyze the volatility of different metrics. Additionally, Analys combines price feeds to determine if the yield is market dependent (which would decrease the protocols' rating).

Note: To reduce costs whilst ensuring a maximal quality, Analys runs a data collection and storage for each TAF every 5 minutes.

Ultimately, considering the 3 main criteria (TVL, liquidity, yield) as well the multiple secondary criteria mentioned above as well as other, Analys assesses a multi-factorial grade (multiple gradings for multiple analysis angles) of each TAF on the protocol side, that will later be used to assess yield expectation as well as risk.

The token's main goal is earning yield in the different protocols using compass, hence it is a utility token. The aim of this approach is to secure a positive price expectation for the token. The token price is however not bound to yields, since these are earned in other tokens, which are then exchanged for ALS at market price.

The second use case of ALS is earning rewards for providing liquidity for the main pairs, also earning newly-generated ALS as incentive for early liquidity providers.

ALS token holders will have the opportunity to shape the future of Alchemis by regularly voting on upcoming features and important decisions. It is a way to reward the community for their trust and ensure the project is heading where users want it.

The liquidity pool planning and documentation is still in development, we thank you for you patience, a complete documentation for this section will be available soon.